Introduction:

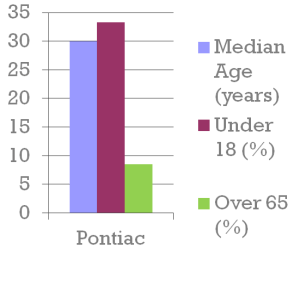

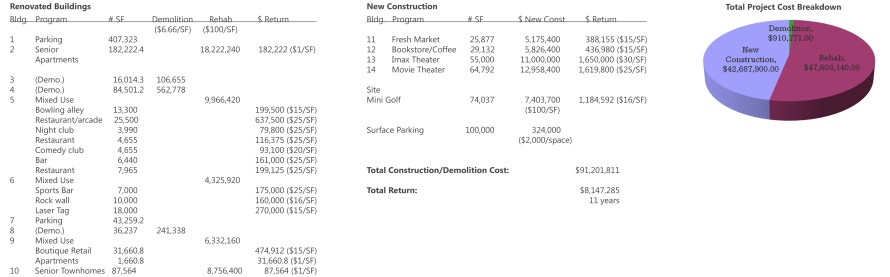

The semester project was to take an existing failing development and prepare a design proposal for the property. Our team was tasked with Bloomfield Park, an abandoned, partially constructed multi-use development that abrubtly ceased construction due to the economic downturn in 2008. The team was to analyze the site and prepare an analytical graphic and written presentation to support our design proposal. The site analysis encompased the existing conditions, municipal regulations, regional demographics, and the development needs of the region. Our design proposal utilized the existing buildings whose structure was not compromised along with new construction. The team had to analyze the feasibility of the proposal by developing a pro forma that illustrated the potenial development cost and length of return. The final project submission included a presentation as well a comprohensive essay.

Objectives:

Create a 100% location

Achieve the highest and best use of land

Use architecture as a catylst for growth

Serve the needs of the exsting community

Team Members:

Amanda Kight

Teffera Kowalske

Kirsten Lyons

Mai Zhang

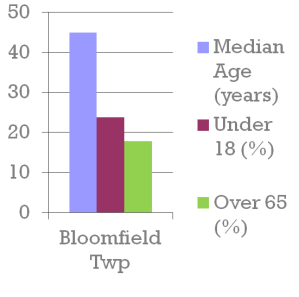

Site Data:

Acreage

Pontiac- 74.91 acres

Bloomfield Twp.- 5.82 acres

Existing Zoning

Bloomfield Twp- Pontiac 425 Agreement Area

Research Park

General Business

Existing Land Use

Commercial

SEV Value $11,900,000

Percieved Needs of Region

Land Use Typology Gap

Restaurants

Grocery & Food Stores

Bars & Cocktail Lounges

Amusement

Hospitals & Medical Centers

Bloomfield Twp. Market Gap

Financial, Insurance, and Real Estate Services

Health Services

Legal Services

Retail Trade

Restaurants

Specialized Grocery Stores

Professional, Scientific and Technical Services

Best Use of Land:

Entertainment/ Recreation

Imax Theater/ Movie Theater

Restaurants/ Bars

Wine/ Cigar Lounge

Comedy Club

Bowling Alley

Miniature Golf

Rock Wall

Laser Tag

Retail

Specialty/Boutique Retail

Fresh Market

Major Bookstore

Residential

Luxury Senior Apartments

Lofts over Retail

Development of Existing Buildings

Bloomfield Entertainment District

Conclusion:

If all of the demolition and construction were to be done immediately, costs for both are estimated at $91 million. State equalized values, considered to be the same as market value for this pro forma analysis, for all of the parcels making up the property total nearly $12 million. This brings the total projected cost for the project to $113 million with a return on investment of just over $8 million per year for over 14 years. A scenario of phasing to bring in revenue sooner might be considered with the retail frontage, movie theaters, and housing completed first. This would be followed by the other entertainment, dining, and retail venues. Even with the aggressive building and renovating planned for the site there is still plenty of room for expansion and future uses. These could easily include more of the same plus hospitality, a corporate campus, or a medical campus.

By any standards, the development of Bloomfield Park would be a long-term investment, and its success would be measured in more than just dollars. Invigorating a struggling community while enhancing a thriving one could become a unique opportunity to model a new spirit of urban re-development. The financial, social, and economic challenges of this site must be met with strength and vision. Profits would not come easily or quickly but could be achieved in time.Howeverr, this team was ready to accept these challenges and move forwardon re-writing Bloomfield Park’s future.

Back to Land Economics

Home